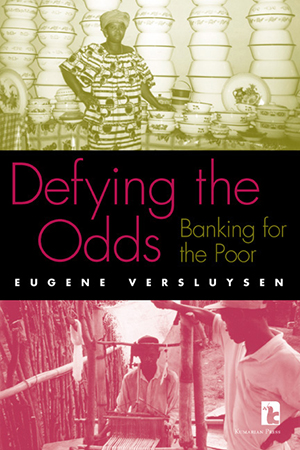

This outstanding study focuses on the growth of microfinance in the context of social and economic change—and upheavals—in developing countries. Rather than relying on one-dimensional technical analyses, Eugene Versluysen presents the experiences and achievements of microfinance institutions and their clients in the form of country-based case studies. He emphasizes how important it is for people, who have never had access to credit, to be given the opportunity to use credit to become self-sufficient and support themselves and their families.

Eugene Versluysen, now retired, was an economist at the World Bank.

"This book is a magnificent blend of in-field research and lucid analysis. The author has combined his profound knowledge of both micro and macro finance to write a highly competent and inspiring study on the role of microfinance in socially-oriented development. A ‘must’ for those involved in finance for development."—Jan Joost Teunissen, Director, Forum on Debt and Development (FONDAD)

"Microfinance is a topic about which an extraordinary amount of nonsense is written. Anyone interested in a serious treatment of the topic should read Eugene Versluysen's book, which sorts sense from nonsense, does not romanticize, and offers operational insights based on a strong analytical framework. One can only hope that other work on the subject will rise to this standard."—John Weeks, Director, Centre for Development Policy and Research, School of Oriental and African Studies, University of London